The real estate and property sectors have been the subject of enhanced exposure in South Africa’s legislative and regulatory compliance landscape in 2022. The Property Practitioners Act No. 22 of 2019 (PPA), which has now formally replaced the Estate Agency Affairs Act No. 112 of 1976 (EAAA), came into operation on 1 February 2022. The Financial Intelligence Centre (FIC) has also recently, on 17 March 2022, issued an assessment report (Report) dissecting the inherent money laundering and terrorist financing risks in the real estate sector, which predominantly focuses on estate agents as having potential vulnerabilities for money laundering and terrorist financing, which will be explored in further detail following a high-level summary of the PPA.

The PPA in Summary

The PPA has ushered in significant changes to the broader property industry and has a more intense focus on the protection of consumers.

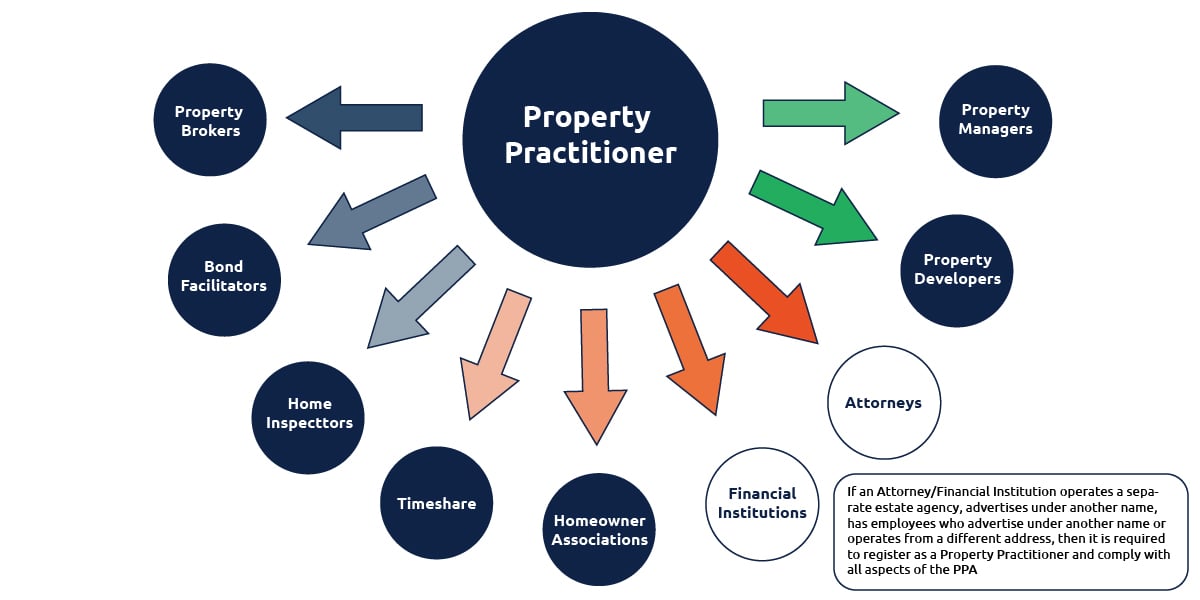

The PPA has a broader scope of property industry inclusion compared to the EAAA and has defined a new umbrella concept of a “Property Practitioner”. A Property Practitioner essentially includes all natural or juristic persons directly or indirectly involved in the selling, purchasing, letting, renting, financing, managing and marketing of property on the instruction of any person or on their behalf.

Instead of purely focusing on estate agents, the PPA now includes property brokers, bond facilitators, home inspectors, companies selling timeshare, homeowner associations, property developers and property managers as practitioners falling within its ambit. Importantly, Attorneys are specifically excluded from the ambit of a Property Practitioner as well as persons selling their own property. In addition, those entities falling within the ambit of a “financial institution” in terms of section 1 of the Financial Services Board Act No. 97 of 1990 are also excluded, which include pension fund organisations, banks, collective investment schemes as well as long and short-term insurers.

However, as a caveat, if an Attorney or a financial institution operates a separate estate agency, advertises under another name, has employees who advertise under another name or operates from a different address, then it is required to register as a Property Practitioner and comply with all aspects of the PPA.

Any natural or juristic person falling within the scope of a Property Practitioner is required to be in possession of a Fidelity Fund Certificate (Certificate), without one practitioners may not receive fees nor render services to clients. Importantly, a BEE certificate and a tax clearance certificate are documents that are prerequisites to the granting of a Certificate. The PPA broadens the scope of inclusion for which practitioners must be in possession of a Certificate, including every director of a company, every trustee of a trust, every member of a close corporation and every partner of a partnership. Therefore, not only must the Property Practitioner’s business be in possession of a Certificate but also every Property Practitioner in their individual capacity and who represents the business.

In addition, to ensure consumer-focused rights, the validity of the Certificates must be stated in every agreement relating to the property-related transaction as well as stated on the business letterheads and marketing material of a Property Practitioner. They must be easily available for purposes of inspection by consumers and Property Practitioners must have the Certificate displayed in every place of business where they conduct property transactions. A Property Practitioner is not entitled to any remuneration unless they are in possession of a Certificate and a Conveyancer is not allowed to pay any remuneration to a Property Practitioner unless they have provided the Conveyancer with a certified copy of the Certificate. Importantly, the PPA forbids any practice in which a Property Practitioner provides a consumer with an incentive to use a particular conveyancer or service provider, which will likely have a considerable practical impact for practitioners.

Another important inclusion to protect consumers undertaking transactions within the property industry is that the PPA makes it mandatory for Property Practitioners to deliver a defect disclosure form to a seller or landlord prior to the conclusion of a mandate and to a purchaser or tenant before an offer is made, which must be signed and form an annexure to the agreement of sale or lease. This will go some way to prevent property purchasers and tenants from being blind sighted by undisclosed defects after they have occupied the property and ensure accountability on the part of sellers, landlords and Property Practitioners.

In terms of trust accounts, every Property Practitioner must open one or more separate account/s, provide the Board of the Property Practitioners Regulatory Authority (PPRA) (Board of Authority, previously the Estate Agency Affairs Board) with all information regarding the trust account, appoint an auditor and keep separate accounting records in respect of the various trust account/s and also audit those accounts.

In terms of record keeping, Property Practitioners must keep all documents given to or received from the PPRA, agreements, mandates as well as mandatory defect disclosure forms and advertising and marketing material relating to the Property Practitioner’s business practice for a period of 5 years.

The PPRA’s Board of Authority is entitled to appoint inspectors who are given the power to enter, inspect and search any Property Practitioners business premises without notice, an exception being for private residences where a warrant is required, and to request any document, Certificate, book or record. Should a Property Practitioner be in violation of, or contravene the PPA, the Board has the authority to issue a compliance notice and a fine to the Property Practitioner.

Language specific prioritisation now forms an important part of the PPA in that the applicable agreement of sale or lease must be in the official South African language requested by the purchaser/lessee.

The Estate Agents Fidelity Fund is now known as the Property Practitioners Fidelity Fund, which continues the purpose of this Fund to guard against the theft of trust funds by a Property Practitioner by providing reimbursement in these circumstances.

These are just a few of the noteworthy implications of the PPA. As with any introduction of a new Act, there are still many questions and some clarification needed. DocFox and our compliance team aim to stay close to the developments surrounding the Act and will strive to keep you updated with all the latest developments - specifically relating to how this new Act will fit in the Financial Intelligence Centres requirements. Property Practitioners would be well advised to start thinking about how they can put processes and controls in place in their businesses to ensure their FICAA compliance as the amendment is not a situation of “if” it will happen but rather “when”.

Sign up to our newsletter to be kept up to date with the latest news, you may also want to read our post on The money laundering and terrorist financing vulnerabilities of South Africa’s Real Estate Sector