Adverse media can be defined as unfavourable information that can be found across a variety of news sources, including traditional newspapers, the internet, radio or television.

Reviewing adverse media is an important step in Anti-Money Laundering (AML) compliance as it can allow you to better understand your client’s activity and their reputation in terms of the potential risk they may present.

Performing adverse media checks on your clients can reveal involvement with crimes such as bribery, corruption, money laundering, financial fraud, even links to organised crime, or terrorism. It could also uncover information that may pose a threat to your company’s reputation if you choose to become associated with them.

The Financial Action Task Force (FATF) recommendations state that “Financial institutions should understand the client’s reputation, including if they were previously investigated for money laundering, terrorist financing, or if they faced regulatory penalties.”

This statement is echoed by the Financial Intelligence Centre (FIC) who advise Accountable Institutions to check if there is “any adverse information available about the client from public or commercial sources” as a key part of client due diligence.

But not all adverse media is the same: a particular negative news story may affect a client’s risk profile to varying degrees and negative news may relate to a range of activities and include both civil and criminal misconduct.

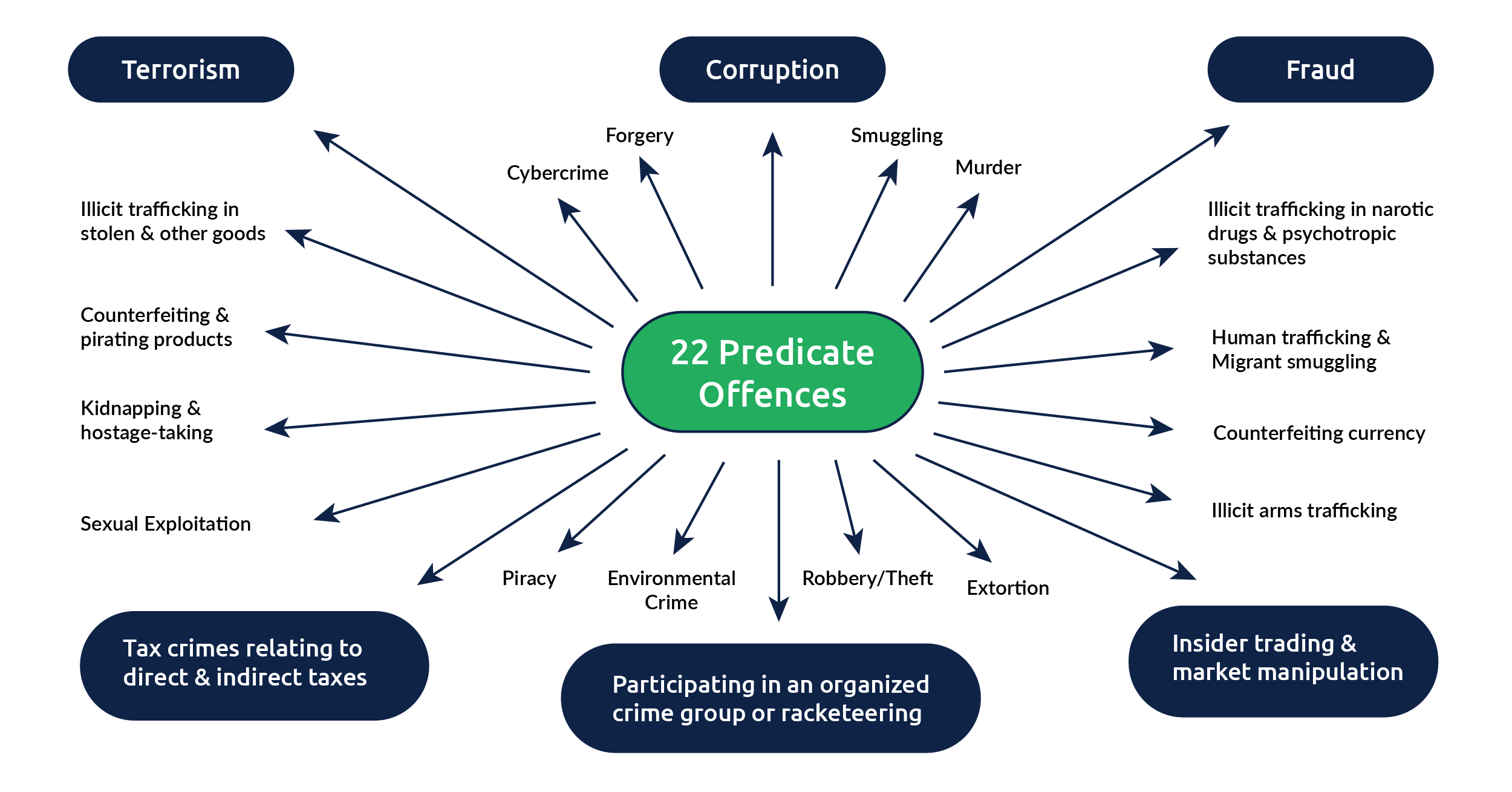

The above image depicts the EU’s AML Directive that highlights 22 predicate crimes that commonly lead to money laundering. Both the FAFT and FIC recommend cross-checking any news results with your client’s profile to determine if the individual or entity mentioned in the negative news corresponds with the client’s identity.

Based on recent reports by the FIC many Accountable Institutions were found to be non-compliant with the FIC Act during inspections over the past year. One of the most common non-compliance related specifically to failure to conduct customer due diligence.

Due diligence includes the monitoring of transactions undertaken by clients throughout the course of their business relationship and ensuring that all client-related information is kept current and up-to-date. Including adverse media as part of your ongoing due diligence can be useful for continuing to understand your client and assessing any potential changing reputational risk of being involved with a specific client.

With DocFox, you can have peace of mind knowing that your clients are continuously screened against AML watchlists, and combs through billions of online news articles searching for adverse media. If your client is making headlines or being mentioned in news articles you will know about it.