In November 2022 the Government Gazette published changes to Schedules 1, 2 and 3 of the Financial Intelligence Centre Act (FICA). The changes increased the number of institutions and businesses identified as Accountable Institutions who are subject to fulfill all FICA requirements. One of the new categories added as an Accountable Institution is that of High-Value Goods Dealers (HVGDs).

Since the announcement there has been considerable uncertainty among individuals as to whether their business falls within this category. To provide clarity, we have compiled an infographic detailing some of the most important FICA facts you need to know as a HVGD.

Since the announcement there has been considerable uncertainty among individuals as to whether their business falls within this category. To provide clarity, we have compiled an infographic detailing some of the most important FICA facts you need to know as a HVGD.

1. What is a HVGD as defined by the FIC?

A HVGD is a person (both natural and juristic) that conducts business by dealing with high-value goods and receives payment(s) of R100 000.00 or more. In order to fall within this category, the good(s) should be any single physical item valued at R100 000.00 or more. The FIC’s Public Compliance Communication 58 (PPC 58) clarifies how this definition should be interpreted and applied.

2. What is required of a HVGD?

As per the FIC Act, a HVGD is an Accountable Institution and therefore must comply with all the FICA requirements. The first step is to register on the FIC website, in terms of section 43B of the FIC Act. Read more about the other key FICA requirements here.

3. What are some examples of items that fall within the HVGD category?

Heavy equipment, machinery, Kruger Rand dealers (the coin can be either gold, platinum or silver), motor vehicles, yachts, vehicle parts, and any precious metals / stones and art over the value of R100 000.00 are all examples of HVG items.

4. What items are excluded from HVGDs?

Excluded from the definition of high-value goods are non-tangible items e.g. shares and trading stock. In other words, the high-value good must be an actual physical item.

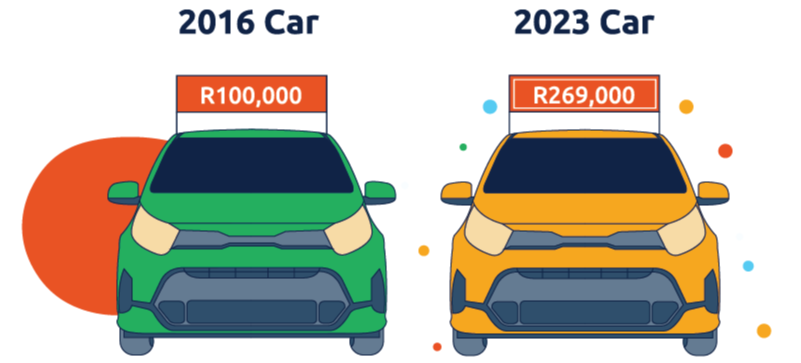

5. Is a good still classified as a HVG if it is not purchased “new”?

New and second hand goods of the value of R100 000.00 or more qualify as High Value Goods.

6. What if I only stock just a few items worth

R100 000.00 but most of my inventory are much lower price points?

If any single item in the inventory can be sold for R100 000.00 or more, the business is considered as a HVGD.

7. What happens if an item is valued at R100 000.00, but is paid for in smaller transactions?

Regardless of the payment structure or schedule, whether in a single payment or a series of smaller structured payments, if the sale value of the item equates to R100 000.00 or more, it qualifies as a high value good.

8. What is a common misconception about HVGDs?

A common misconception is that buying multiple items of a lesser value that amount to R100 000.00 or more is considered a high-value goods deal. This is not true.

9. Why are HVGDs listed as Accountable Institutions?

HVGDs are vulnerable to criminals for money laundering and terrorist financing. Research shows that criminals often seek to buy high-value goods, which can easily be converted into cash and used to transfer value, and your business could be prone to such abuse.