It is official, the Minister of Finance, has amended schedules to the Financial Intelligence Centre Act.

On 29 November 2022 the Government Gazette published changes to Schedules 1,2 and 3 of the Financial Intelligence Centre Act (FIC Act) that come into effect on 19 December 2022.

A key step in addressing the risk of South Africa being grey-listed, the change seeks to tackle some of the key weaknesses identified in the 2009 and 2021 Financial Action Task Force (FATF) mutual evaluations of South Africa.

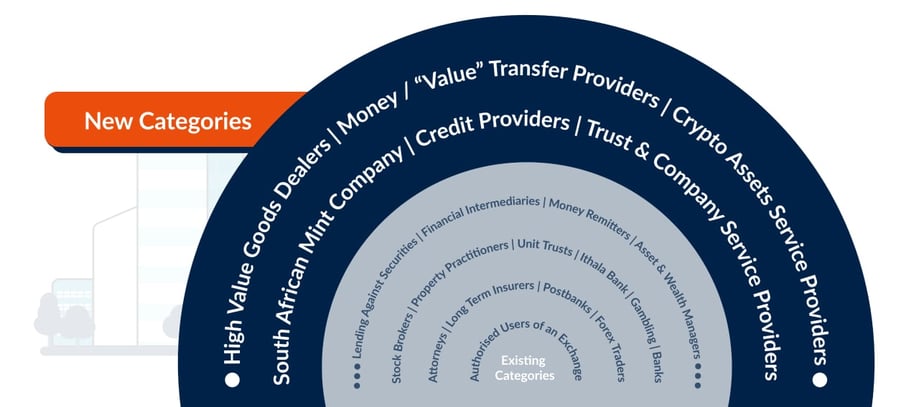

The amendments give the effect of closing gaps in anti-money laundering (AML) and counter financing of terrorist (CFT) coverage in South Africa by expanding the reach of the FIC Act. Whilst it will significantly increase the number of people and firms identified as Accountable Institutions who will now be subject to its full requirements, it does provide the Financial Intelligence Centre with additional valuable intelligence across a broader range of financial and non-financial industries at risk of being leveraged by those with criminal intent.

The New Categories in FIC Act Schedule 1 Include:

-

All High Value Goods Dealers who sell a single item for R100,000 or more, regardless of how payment is made

-

Trust and Company Service Providers

-

Credit Providers who are subject to the National Credit Act (NCA) and a person who carries on the business of providing credit in terms of any credit agreement outside of the NCA

-

Crypto Asset Service Providers

-

South African Mint Company regarding the distribution of non-circulation coins in retail trade

-

Money or “Value” Transfer Providers

These new additions include those sectors previously identified as Reporting Institutions in Schedule 3, and as such they are now removed.

The people and firms newly identified as accountable institutions businesses will be required to register with the Centre as Accountable Institutions and fillful the full set of regulatory obligations set down by the FIC Act.

These include implementing a risk-based approach to customer identification and verification and due diligence, appointing a compliance officer, training employees, reporting suspicions, and maintaining and implementing a keystone risk management and compliance programme (RMCP).

Whilst there will be an 18-month transition period, supervisory bodies will conduct inspections to correct any identified areas of non-compliance, though they have stated that they do not envisage issuing financial penalties for non-compliance with the FIC Act during this initial transitional period. Regardless of this, it is recommended to work towards compliance sooner rather than later.