Money Laundering and Terrorist Financing are often used in the same sentence, and while there can be some similarities in terms of process, they are fundamentally distinct.

Money Laundering

The goal of most criminal acts is to generate a profit and so criminals commonly seek to disguise the true source of these funds so that they may use and enjoy their ill-gotten gains without raising suspicion.

Money laundering is the process used to help them achieve this aim and refers to the passing of illicit, or ‘dirty’ money through a sequence of transfers, changes or commercial transactions that eventually returns the ‘clean’ money back to the launderer in an obscure and indirect way, and in many cases, it is almost impossible to link back to the original crime.

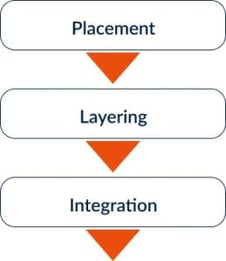

Although real-life money laundering and terrorist financing schemes can be large, complex, and sometimes incredibly creative, they all tend to follow the same three-stage process.

The first is placement, this is where illicit funds are initially deposited into a legitimate financial system. The funds are then moved into the layering stage where it becomes separated from the illicit origins through layers of sequential movements, transactions, divisions, or consolidations. The idea here is to put space between the true source and its original origin. The final stage is integration. At this point, the illicit funds have been through so many different transactions that it is practically impossible to see the original source.

The first is placement, this is where illicit funds are initially deposited into a legitimate financial system. The funds are then moved into the layering stage where it becomes separated from the illicit origins through layers of sequential movements, transactions, divisions, or consolidations. The idea here is to put space between the true source and its original origin. The final stage is integration. At this point, the illicit funds have been through so many different transactions that it is practically impossible to see the original source.Once the illicit funds have been ‘cleaned’ the criminals can effectively use the money without raising suspicion, whether that be setting up a legitimate business or investment to provide ongoing benefits or a simple old-fashioned splashing out on a new house or the latest top of the range Mercedes or Range Rover.

The key here is that the original source of funds is always illegal, and the flow of funds is circular, ultimately returning the funds back to the criminal.

Terrorist Financing

The term ‘terrorist financing’ involves the financing of terrorist acts, and of terrorists and terrorist organisations.

Whilst the financing of terrorism may include the provision of money, it can also include the purchase, holding, or transaction of any assets that might be useful to acts of terrorism. This could include physical supplies such as housing, arms, vehicles, chemicals, or equipment.

Although the ultimate purpose of the funds is to support illegal political activities, the source of those funds is not necessarily illegal.

Terrorists can obtain funding through a variety of legal sources as well as illicit sources such as organised crime and may include anything from corporate or government sponsorship, donations, and even legitimate business activities set up for the main purpose of providing funding.

The key here is that the original source of funds may or may not be illegal and the flow of funds is linear, ultimately heading in the direction of supporting a terrorist organisation’s activities.

Although the two differ in many ways, they often take advantage of the similar techniques of anonymity and creative use of products and services to evade detection of their true purpose and move value or property.

In order to mitigate the risk of unknowingly being involved in terrorist financing processes, the Financial Intelligence Centre Act (FICA) requires Accountable Institutions to screen their clients against the United Nations Targeted Financial Sanctions (TFS) list. This list primarily identifies individuals and entities that have been identified as being connected to terrorist activities.

To add to this, we have created a comprehensive South African screening list, to notify you if any clients or potential clients are high risk.