The Financial Intelligence Centre Act (FICA) was introduced to fight financial crime, such as money laundering, tax evasion and terrorist financing activities by making it more difficult for criminals to benefit from the proceeds of crime. As the country’s financial intelligence unit, the Financial Intelligence Centre (FIC) implements its role in the country’s framework for anti-money laundering, countering the financing of terrorism and proliferation (AML, CFT and CPF).

The FIC Amendment Act (FICAA) brought South Africa closer to international standards and best practices recommended by the Financial Action Task Force (FATF).

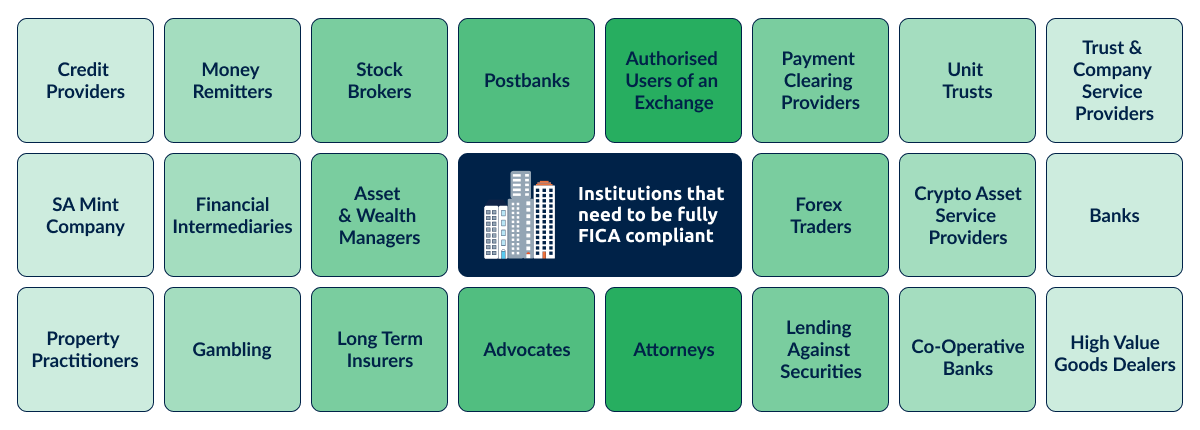

FICA states that all Accountable Institutions (AIs) need to be fully compliant with the Act. The (FIC) states that, “An accountable institution is defined as a person, or an organisation referred to and listed in Schedule 1 of the FIC Act that carries on the business of any entity. Accountable institutions must fulfill certain obligations in terms of the FIC Act.”

As at February 2024 businesses/sectors that fall into the following

categories are regarded as AIs, including:

There is more to FICA than just an ID and a proof of address document collection, in order for an AI to be fully compliant they are required to perform the following:

You can read more about the FICA obligations here.